Depreciation calculation formula

Per unit Depreciation Asset cost. The effective tax rate refers to the actual taxes paid by a corporate and is equal to the taxes paid divided by the pre-tax income.

Methods Of Depreciation Learn Accounting Method Accounting And Finance

The printer costs 500.

. Depreciation Cost of asset Residual Value x Annuity factor. The true liquidity refers to the ability of a firm to pay its short term obligations as and when they become due. The cost is listed in cell C2 50000.

Under the straight-line method the formula for depreciation is expressed by dividing the difference between the asset cost and the residual value by the assets useful life. Read more as is 5267 million while amortization is 877 million. For the double-declining balance method the following formula is used to calculate each years depreciation amount.

Double-Declining Method Depreciation Double-Declining Depreciation Formula To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life. As depreciation is added to the OCF formula depreciation does not affect OCF. It is important to measure the decrease in value of an asset and account for it.

Depreciation expense is 10500 in the income statement. A small business decides to purchase a new printer for its office. Let us take the example of a company ABC Ltd and calculation of capital expenditure in 2018 based on the following information.

The highlighted box in red is the Net Block value you will see in the companys balance sheet for 2017. Lower net income results in lower tax liability too. Accounting students can take help from Video lectures handouts helping materials assignments solution On-line Quizzes GDB Past Papers books and Solved problems.

This is a guide to Annuity Formula. Calculation of Formula 1. Once this depreciation calculation process is repeated for all five years the Total Depreciation line item sums up the depreciation amount for the current year and all previous periods to date.

Double Declining Balance Depreciation Method. Tax benefits also take place in depreciation. Below is an Extract of the Effect of Depreciation detailed Calculation is in the Excel Sheet.

Changes in Operating Assets and Liabilities. We then invest this amount in Government securities along with the interest earned on these securities. The earnings before interest taxes depreciation and amortization EBITDA formula is one of the key indicators of a companys financial performance and is used to determine the earning.

Once purchased PPE is a non-current. Liquid ratio is also termed as Liquidity Ratio Acid Test Ratio or Quick RatioIt is the ratio of liquid assets to current liabilities. Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders.

We also provide an Annuity calculator with a downloadable excel template. Depreciation Cost of Asset Net Residual Value Useful life 400000 400003 120000 pa. This means that it does not.

Annual Depreciation expense Asset cost Residual Value Useful life of the asset. Straight Line Depreciation Formula. Salvage value is the value of the asset at the end of its useful life.

The straight line depreciation formula for an asset is as follows. Calculate per unit depreciation. We need to define the cost salvage and life arguments for the SLN function.

Depreciation is an ongoing process until the end of the life of assets. Useful life of asset represents the number of periodsyears in which the asset is expected to be used by the. Under this method we transfer the amount of depreciation every year to the sinking fund Ac.

On the income statement it represents non-cash expense but it reduces net income too. Depreciation is a decrease in the book value of fixed assets. Calculation of amount of depreciation.

2 x Straight-line depreciation rate x Remaining book value A few notes. The formula of Depreciation Expense is used to find how much asset value can be deducted as an expense through the income statement. Below is a more in-depth definition of the key terms in Earnings Before Interest Taxes Depreciation and Amortization.

CAPEX Formula Net Increase in PPE Depreciation Expense. Accumulated Depreciation Formula Table of Contents Formula. Unit of Production Method.

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

There are three major methods used in the calculation of depreciation. Following are the 3 principal features of depreciation. The below template is the data for the calculation of the Operating Cash Flow Equation.

Sinking fund or Depreciation fund Method. Cost of the asset is the purchase price of the asset. Depreciation may be defined as the decrease in the assets value due to wear and tear over time.

Thus we calculate. Formula to Calculate Depreciation Expense. Liquid or Liquidity Ratio Acid Test or Quick Ratio.

Depreciation involves loss of value of assets due to the passage of time and obsolescence. Double Declining Balance Method. For example the total depreciation for 2023 is comprised of the 60k of.

If this depreciation is used the book value of the equipment at the end of year 5 will be 38880 64800 25920 that is less than the salvage value. Calculator For Time Value of Money Formula. Step 3 calculation of depreciation expense and preparation of schedule.

Salvage is listed in cell C3 10000. Here we discuss how to calculate Annuity along with practical examples. The following is an example of a straight line depreciation calculation.

One downside of using the straight-line depreciation method is that it bases the useful life calculation used in this formula on a guesstimate. Interest the expenses to a business caused by interest rates such as loans provided by a bank or similar third-party. Since there is a difference between the pre-tax income reported on the financials as prepared following accrual accounting standards and the taxable income reported on tax filings the effective tax rate often differs from the.

Depreciation can be seen from the Cash flow statement Cash Flow Statement A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Investors should choose a company with high or improving. You may also look at the following articles to learn more Formula For Future Value of Annuity Due.

Depreciation means the decrease in the value of fixed assets due to normal wear and tear efflux of time etc. Relevance and Uses of Depreciation Expenses Formula. Hence the calculation is based on the output capability of the asset rather than the number of years.

First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate. The book value of the equipment at the beginning of year 5 is 64800 whose 40 is 25920. The formula for straight-line depreciation is.

Operating profit is given as 23716 million. It is a non-cash expense forming part of profit and loss statements. Effective Tax Rate Definition.

Annuity Formula Annuity Formula Annuity Economics Lessons

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Depletion Method Of Depreciation Accounting Education Economics Lessons Finance Class

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

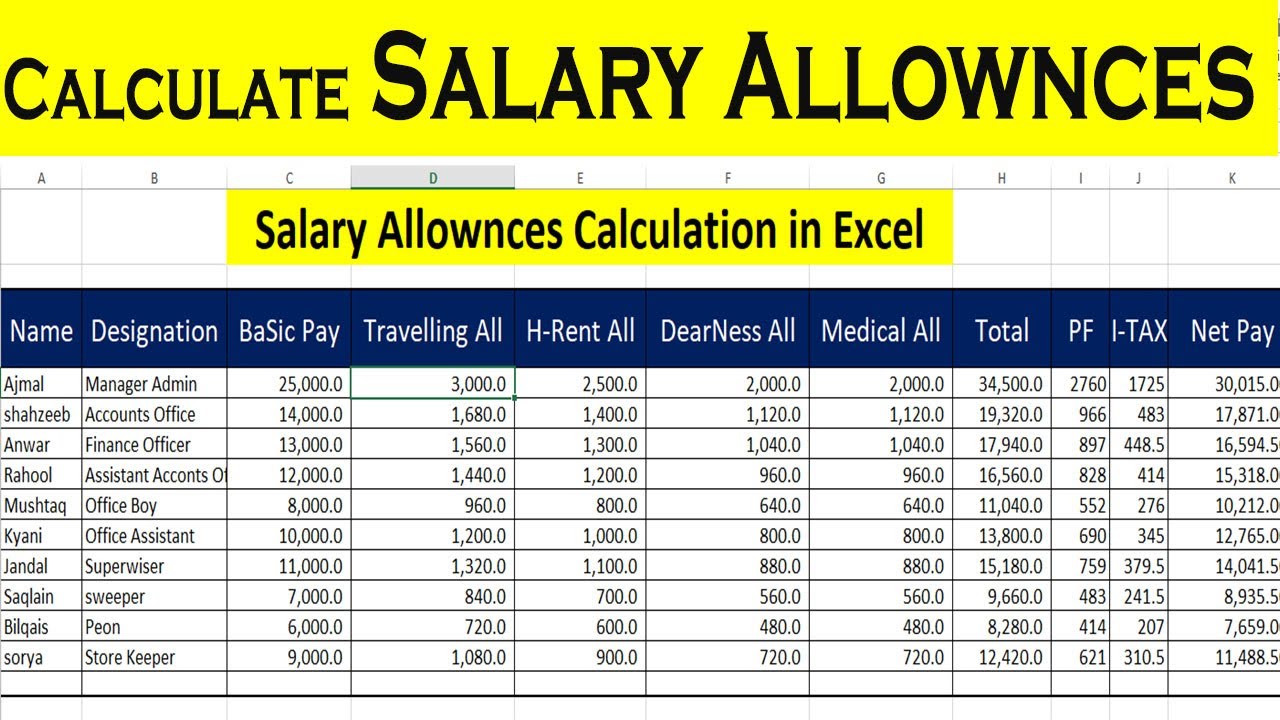

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

Accelerated Depreciation Method Accounting Basics Accounting And Finance Accounting Education

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education

How To Calculate Depreciation On Fixed Assets Fixed Asset Math Pictures Economics Lessons

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance