42+ how much mortgage interest can you deduct

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web Basic income information including amounts of your income.

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

. This has been a severe blow to not-so. Homeowners who bought houses before December 16 2017 can. Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate.

That cap includes your existing. We dont make judgments or prescribe specific policies. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Homeowners who are married but filing. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Our Calculators And Resources Can Help You Make The Right Decision. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

Ad Learn More About Mortgage Preapproval. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web The 2017 change to the current federal tax law limits the mortgage interest deduction a major tax break for homeowners. And lets say you also paid. Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on.

For tax year 2022 those amounts are rising to. Use NerdWallet Reviews To Research Lenders. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web Most homeowners can deduct all of their mortgage interest.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Take Advantage And Lock In A Great Rate.

However higher limitations 1 million 500000 if married. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. See what makes us different.

Browse Information at NerdWallet. So lets say that you paid 10000 in mortgage interest. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

Web Mortgage Interest Tax Deduction Limit. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Knowing How Much You Can Afford Is The First Step Towards Homeownership.

If you took out your home loan before.

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction How It Calculate Tax Savings

Rental Income Property Analysis Excel Spreadsheet Investment Analysis Mortgage Comparison Investing

A Guide To Mortgage Interest Deduction Quicken Loans

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Can I Claim The Mortgage Interest Deduction

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction A Guide Rocket Mortgage

Business Succession Planning And Exit Strategies For The Closely Held

Prince William Area Family Economic Success Partnership Ppt Download

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

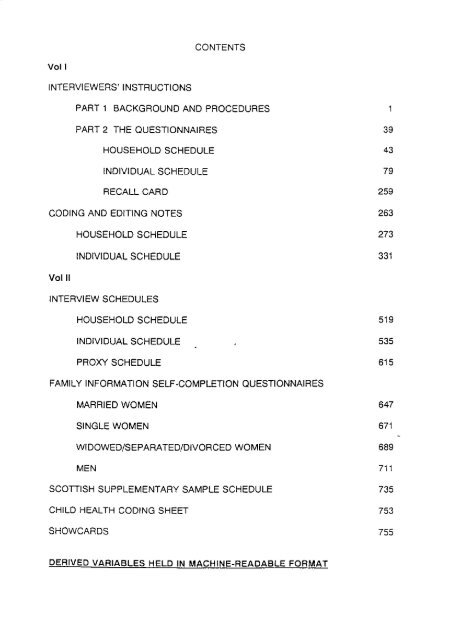

Contents Vol I Interviewers Instructions Part 1 Esds